Take control and manage your money

Getting Started

Order and activate your Card.

-

Simply give us your name and mailing address and your card will arrive in 7-10 business days.1

Residents of the State of Vermont are ineligible to open a card account. -

Once your card arrives in the mail, activate your card and verify your identity1. Come back to this website (it's a good idea to bookmark it now) and activate online, or call 1-800-214-5483.

Adding Money

The Western Union® Netspend® Prepaid Mastercard® offers many ways to add money to your Card Account.

- Direct Deposit of your paycheck, government benefits (such as Social Security, SSI, or SSDI), or other regular payments.

- Receive Western Union® Money Transfer transactions directly onto your Card Account.3

- Transfer money directly from a qualifying bank.3

- Visit any of the over 130,000 reload locations in the Netspend® Reload Network.4

Tax Refund

You could get your tax refund disbursement faster5 when you e-file and use Direct Deposit!

- Request a Western Union® Netspend® Prepaid Mastercard® now and it will arrive in about 7-10 business days with your Routing Number and Account Number. If you already have a card, log in to your Online Account Center to get your numbers and go to step 3.

- Activate and verify your identity1 for your new Western Union® Netspend® Prepaid Mastercard®.

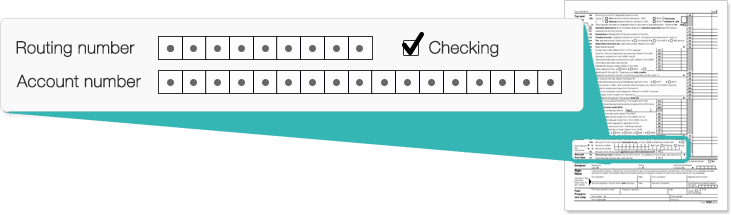

- When filing your taxes, put your Routing Number and Account Number in the designated fields (shown below) and indicate 'Checking' as the account type. If you have a professional tax preparer, give them these numbers.

** ATTENTION JOINT FILERS: Please make sure both parties are listed on the account. **

What it Costs

A fee plan offered by companies you can trust.

The Western Union® Netspend® Prepaid Mastercard® has a fee plan with an option that's just right for you.

As an added bonus, after you Direct Deposit at least $500 of your payroll or government benefits into your Card Account during one calendar month, you're eligible for the $5 per month Reduced Monthly Plan that includes:

- Purchase transactions for just $5 per month - our lowest monthly fee!

- If you're short of funds, we may cover you with a Purchase Cushion up to $10.00.6

- Personalize your Western Union® Netspend® Prepaid Mastercard® at no cost!7 Add a picture of a loved one, a special place or even a photo of yourself. Learn more at wunetspendprepaid.com.

| Three Purchase Plan Options: | Pay-As-You-Go Plan* | Monthly Plan | Reduced Monthly Plan** |

|---|---|---|---|

| Plan Fee | No Fee | $9.95 per month | $5.00 per month |

| Signature Purchase Transaction Fee*** | $1.50 each | Included in Plan | Included in Plan |

| PIN Purchase Transaction Fee*** | $1.50 each | Included in Plan | Included in Plan |

| Balance Inquiry Fee |

|

||

| Inactivity Fee | $5.95 per month. Fee applies if there are funds in the Card Account and the Card

Account has had no activity, i.e., no purchases; no cash withdrawals; no load transactions; and no

Balance Inquiry Fee for ninety (90) days. If enrolled in the Monthly Plan and your Card Account has had no activity as described above, this fee applies instead of the Monthly Plan Fee. |

||

| Foreign Transaction Surcharge**** | 4% per foreign transaction. Calculated based on the U.S. Dollar amount of the purchase transaction or cash withdrawal. Charged in addition to any applicable Purchase Transaction Fee or OTC Withdrawal Fee. | ||

* The Pay-As-You-Go Plan is automatically effective on your Card Account when you first obtain the Card. If you wish to change to another Purchase Plan, just call 1-800-214-5483 or visit www.wunetspendprepaid.com.

** Enrollment in the Monthly Plan is optional and covers only purchase transaction fees. It does not include ATM fees or any other fees associated with the use and reloading of the Card Account. To qualify for the Reduced Monthly Plan you must receive $500 in payroll or government benefit direct deposits in 1 calendar month. Upon qualifying, discounted fee takes effect on enrolled Cardholder's next Plan Fee assessment date. Pay-As-You-Go Cardholders must enroll in the Monthly Plan to activate the Reduced Monthly Plan. See the Cardholder Agreement for details.

*** During checkout, select 'CREDIT' on the keypad to make a Signature Purchase, or select 'DEBIT' and enter your PIN to make a PIN Purchase.

**** The exchange rate between the transaction currency and the billing currency used for processing international transactions is a rate selected by Mastercard, see section labeled 'Transactions Made in Foreign Currencies and/or with Merchants Located in Foreign Countries.'

| Direct Deposit Fee | No fee |

|---|---|

| Cash Reload at a Netspend® Reload Network Location | Up to $3.95 per load. Fee is determined and assessed by operator of Netspend® Reload Network location, and varies depending on location. This is a third-party fee and is subject to change. |

| Funds Transfer Fee* | Visit your Online Account Center to learn how to transfer funds between your Card and a bank account or third party. You can see a full range of options and applicable fees in your Online Account Center. Depending on the transfer service you select, a fee may be assessed to your Card Account or to the transferor. The fee may be determined by a variety of factors set by the service provider, such as speed, amount, or destination. Some of the fees are assessed by third parties or the originating bank, and are not assessed by Bank. |

| Western Union® Money Transfer Fee |

Fee Varies Per transfer. |

* Fees to send a money transfer from your Card Account will vary based on a number of factors, such as amount sent, delivery method and receiving country. Make sure you check the fees and, if applicable, exchange rate, before you send. Western Union also makes money from currency exchange. When choosing a money transmitter, carefully compare both transfer fees and exchange rates. This is a third party fee, not assessed by the Bank.

| Balance Inquiry Fee |

|

|---|---|

| Check Request Fee | $5.95 for processing and mailing of a return of funds check at Card Account closure. Refund checks are not issued for balances of less than $1.00. If your Card Account balance will be reduced to less than $1.00 after the Check Request Fee is debited, the Check Request Fee will be waived. See Cardholder Agreement for alternative options to remove the funds from your Card Account. |

| Additional Statement Mailing Fee | The fee for a written transaction history in any calendar month is $0. Statements are also available by logging in to your Online Account Center at wunetspendprepaid.com or by calling 1-800-214-5483. |

| Additional Card Fee | No fee for each additional Card requested that is not a replacement Card. |

| Replacement Card Fee | $3.95 per lost, stolen, or damaged Card replaced. |

| Inactivity Fee | $5.95 per month. Fee applies if there are funds in the Card Account and the Card Account has had no activity, i.e., no purchases; no cash withdrawals; no load transactions; and no Balance Inquiry Fee for ninety (90) days. If enrolled in the Monthly Plan and your Card Account has had no activity as described above, this fee applies instead of the Monthly Plan Fee. |

| ACH/Preauthorized Payment Transaction Decline Fee | $1.00 per declined ACH transaction. |

|---|---|

| Stop Payment Fee | No fee. |

| Custom Card Fee | $4.95 per custom card. |

|---|

Please scroll down for disclosures.

Using Your Card

More than just sending money.

Use your card everywhere Debit Mastercard® is accepted

Use your Western Union® Netspend® Prepaid Mastercard® to shop online, in stores, over the phone or get cash at ATMs!8 Use your card to buy groceries, fill up the car with gasoline, shop for new clothes, pay for healthcare needs or even for a family vacation.

Send and Receive Western Union® Money Transfers3

Use your card to send a Western Union® Money Transfer to over 200 countries and territories or receive a Western Union® money transfer directly onto your Card Account.3 You can even perform the Western Union® Money Transfer transaction online and from the comfort of your home.

Pay Your Bills9

With the Western Union® Netspend® Prepaid Mastercard® you can pay bills like rent, mortgage, cable TV, Internet, natural gas, electricity, insurance, auto loans, student loans and others online.9

Reward Yourself

Make your money work for you.

Refer Your Family and Friends

Use the Western Union® Netspend® Prepaid Mastercard® Refer-a-Friend program and when your family and friends fund their new card with at least $40 in cash or with Direct Deposit, you could each get a $20 credit!10

Cash Back Rewards

Get special offers from select merchants and earn cash back credits on your Western Union® Netspend® Prepaid Mastercard® for those purchases.11